£7,030 A Month After Tax

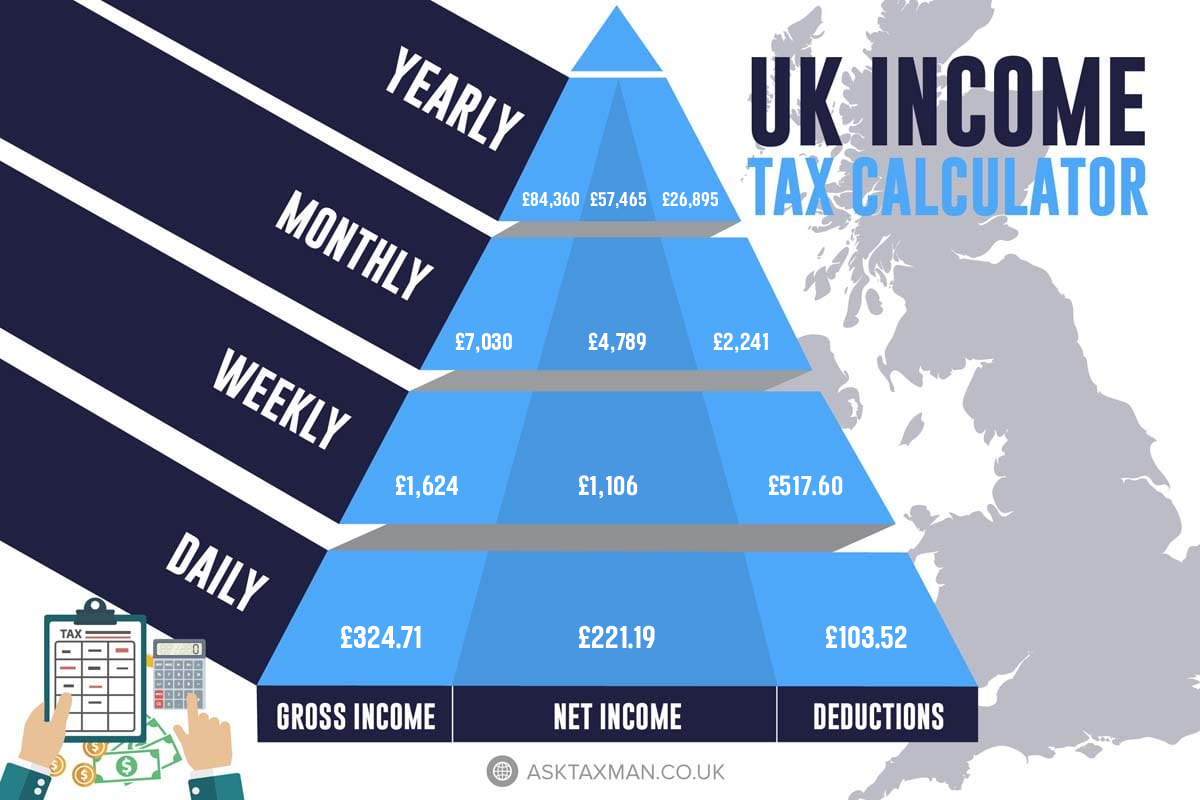

Below is a detailed breakdown of £7,030 a month after tax income. Check how much take-home pay you are left with after TAX and national insurance cut from your £7,030 monthly salary.

£7,030 A Month Breakdown

£7,030 a month after tax breaks down to £57,465 annual, £4,789 monthly, £1,106 weekly, £324.71 daily, £40.59 hourly take-home pay (Net) salary if you're working 40 hours per week.

Tax on £7,030 A Month Salary

| Year | Month | Week | |

|---|---|---|---|

| Gross Wage | £84,360 | £7,030 | £1,624 |

| National Insurance | £5,651 | £470.89 | £108.75 |

| Tax Paid | £21,244 | £1,770 | £408.85 |

| Student Loan | £0.00 | £0.00 | £0.00 |

| Take-Home Pay | £57,465 | £4,789 | £1,106 |

| Tax Free Allowance | £12,500 | £1,042 | £240.57 |

| Taxable Salary | £71,860 | £5,988 | £1,383 |

How much is £7,030 after tax UK?

The £7,030 after tax UK is £0.

How much is £7,030 after National Insurance UK?

The £7,030 after National Insurance UK is £1,379.

What is tax on £7,030 salary UK?

Tax on £7,030 salary UK is £21,244.

Calculating £7,030 A Month After Tax

Our income calculator tells you the net monthly amount that you've left with after tax. To calculate £7,030 a month after tax, we use a formula that takes the variable and applies the selected options from the tax calculator form.

Using only up-to-date HM Revenue data, that calculator can provide you with the £7,030 a month after tax for the current and previous years. Using the calculator, you can accurately determine your monthly take-home pay for this year and for the earlier years. You can even compare the results to observe tax changes over the years.

The goal of our calculators is to give you as accurate a figure of your NET income as possible. Using the same data source as the tax calculator, we can also calculate how much your payment will go towards National Insurance (NI). When you calculate £7,030 a month after tax and NI, you get a clear idea of your take-home salary.

How do people find £7,030 after tax a month UK breakdown?

People do find £7,030 after tax a month UK breakdown with these keywords: 84360 after tax, 84360 after tax uk, £84360 after tax, 84360 after tax and ni, what is 84360 after tax, 84360 pounds after tax, 84360 after tax married, 84360 after tax uk 2026, tax on 84360 salary uk, 84360 salary after tax, 7030 a month after tax, 7030 a month salary after tax.