£8,660 A Month After Tax

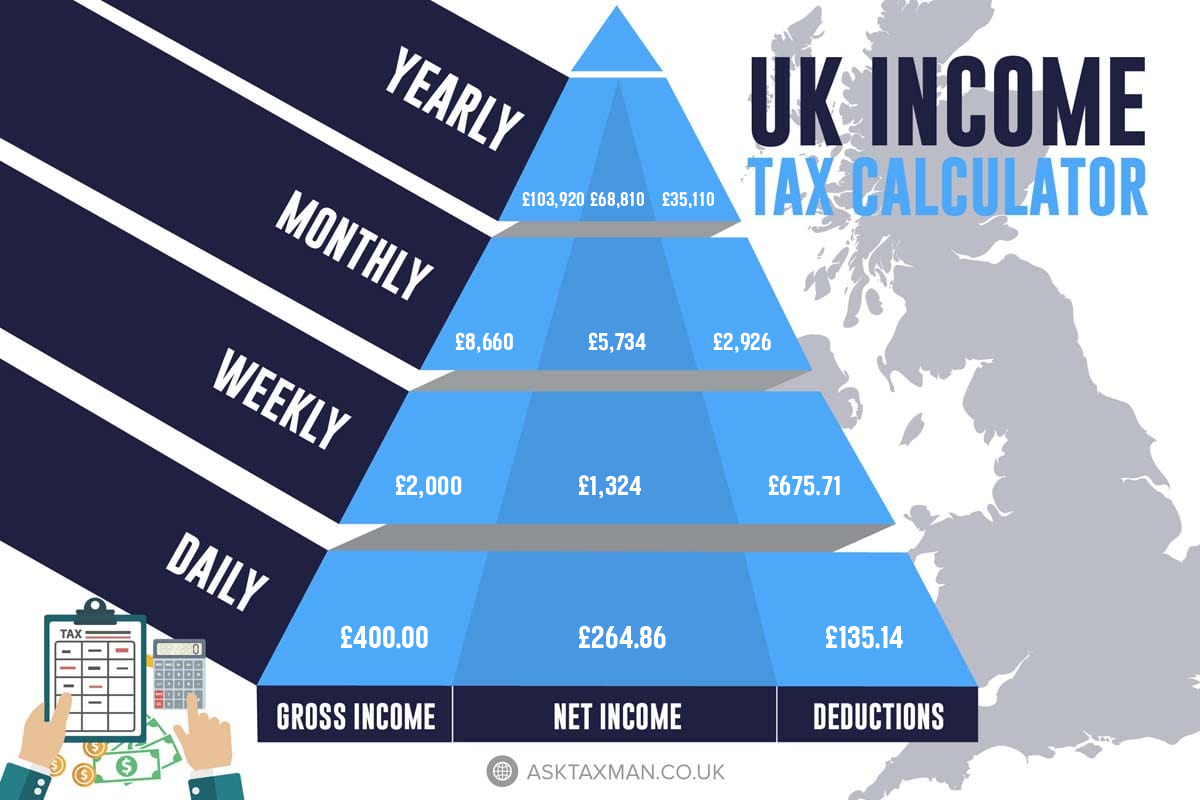

Below is a detailed breakdown of £8,660 a month after tax income. Check how much take-home pay you are left with after TAX and national insurance cut from your £8,660 monthly salary.

£8,660 A Month Breakdown

£8,660 a month after tax breaks down to £68,810 annual, £5,734 monthly, £1,324 weekly, £400.00 daily, £50.00 hourly take-home pay (Net) salary if you're working 40 hours per week.

Tax on £8,660 A Month Salary

| Year | Month | Week | |

|---|---|---|---|

| Gross Wage | £103,920 | £8,660 | £2,000 |

| National Insurance | £6,042 | £503.49 | £116.28 |

| Tax Paid | £29,068 | £2,422 | £559.43 |

| Student Loan | £0.00 | £0.00 | £0.00 |

| Take-Home Pay | £68,810 | £5,734 | £1,324 |

| Tax Free Allowance | £12,500 | £1,042 | £240.57 |

| Taxable Salary | £91,420 | £7,618 | £1,759 |

How much is £8,660 after tax UK?

The £8,660 after tax UK is £0.

How much is £8,660 after National Insurance UK?

The £8,660 after National Insurance UK is £2,618.

What is tax on £8,660 salary UK?

Tax on £8,660 salary UK is £29,068.

Calculating £8,660 A Month After Tax

Our income calculator tells you the net monthly amount that you've left with after tax. To calculate £8,660 a month after tax, we use a formula that takes the variable and applies the selected options from the tax calculator form.

Using only up-to-date HM Revenue data, that calculator can provide you with the £8,660 a month after tax for the current and previous years. Using the calculator, you can accurately determine your monthly take-home pay for this year and for the earlier years. You can even compare the results to observe tax changes over the years.

The goal of our calculators is to give you as accurate a figure of your NET income as possible. Using the same data source as the tax calculator, we can also calculate how much your payment will go towards National Insurance (NI). When you calculate £8,660 a month after tax and NI, you get a clear idea of your take-home salary.

How do people find £8,660 after tax a month UK breakdown?

People do find £8,660 after tax a month UK breakdown with these keywords: 103920 after tax, 103920 after tax uk, £103920 after tax, 103920 after tax and ni, what is 103920 after tax, 103920 pounds after tax, 103920 after tax married, 103920 after tax uk 2026, tax on 103920 salary uk, 103920 salary after tax, 8660 a month after tax, 8660 a month salary after tax.